Usage Guidelines: Allianz, a renowned insurance provider, offers the Allianz Lifestyle Protect's All-in-One plan, a comprehensive living insurance product designed to safeguard your current lifestyle in the event of unforeseen accidents. Recognizing the unpredictability of life, Allianz strives to ensure that your protection remains consistent, allowing you to face any challenges with confidence.

The Allianz living insurance offers a wide range of beneficiary that cover various aspects of your life, including lifestyle, living, care, and well-being. By choosing this insurance plan, you can enjoy peace of mind knowing that you are adequately protected and supported during difficult times.

One of the primary advantages of the Allianz living insurance is its focus on maintaining your lifestyle. In the unfortunate event of an accident, it can be challenging to return to your previous way of life without financial strain. However, with this insurance plan, Allianz provides you with the necessary resources to help you recover and continue living the lifestyle you are accustomed to.

The Allianz living insurance also extends its coverage to aspects beyond lifestyle. It recognizes the importance of holistic well-being and offers benefits that encompass care and well-being. This means that in addition to financial support, you can access services and support systems that contribute to your overall physical and emotional well-being.

By choosing the Allianz living insurance, you gain access to a comprehensive suite of benefits tailored to your needs. These benefits may include financial assistance for medical expenses, rehabilitation costs, and modifications to your living environment if necessary. Moreover, you may also receive support for daily living activities, such as domestic help and personal care services, ensuring that you can maintain a comfortable and dignified lifestyle during your recovery.

Allianz prides itself on providing personalised solutions and excellent customer service. Their dedicated team of professionals is committed to guiding you through the insurance process, answering your queries, and assisting you in making informed decisions regarding your coverage. With Allianz, you can rely on their expertise and industry experience to ensure that you receive the protection you need.

In conclusion, the Allianz living insurance is a comprehensive living insurance product that offers the necessary protection to maintain your current lifestyle in the face of unforeseen accidents. With a focus on lifestyle, living, care, and well-being, this plan provides a range of benefits designed to support you during challenging times. Allianz's commitment to personalised solutions and exceptional customer service makes them a reliable partner in safeguarding your future.

Certification/Claims:

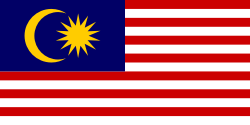

Service Location: Allianz provides its services in Kuala Lumpur, the capital city of Malaysia. As a global insurance provider, Allianz operates in various locations worldwide, including Kuala Lumpur. Customers in Kuala Lumpur can access Allianz's insurance products and services, including the Allianz living insurance, through their local branches, agents, or online platforms. Allianz is committed to serving the insurance needs of individuals and businesses in Kuala Lumpur, offering them reliable coverage, personalised solutions, and excellent customer support.

Operation: The living insurance plans provided by Allianz includes:

Allianz living insurance is a comprehensive living insurance solution that offers extensive coverage and support to individuals and families. With a focus on protecting and maintaining your current lifestyle, this plan provides a range of benefits to safeguard your financial security in the event of unexpected accidents or events. The plan covers various aspects of your life, including lifestyle protection, living benefits, critical illness coverage, disability insurance, snatch theft coverage, and optional benefits like study interruption coverage. By offering financial support for medical expenses, rehabilitation costs, and lifestyle modifications, Allianz ensures that you can recover and maintain your standard of living after an accident. The plan also goes beyond financial assistance, providing access to services and support systems for your care and well-being. Whether it's covering critical illnesses, providing income replacement during disability, or compensating for snatch theft incidents, Allianz aims to provide comprehensive protection to meet your needs. It's important to review the specific terms and conditions of the plan to understand the coverage limits, waiting periods, and exclusions that may apply. With Allianz living insurance, you can have peace of mind knowing that your current lifestyle and financial security are well-protected.

- Extensive coverage

- Various coverage options

- Flexible plan options

- Worldwide coverage

- Hassle-free claims process

Powered by

© 2007 - 2026 DagangHalal.com. All Rights Reserved. Developed and maintained by DagangAsia Network Holding Sdn. Bhd. (1344481-V)

This website is best viewed using Internet Explorer 11 or above, Mozilla Firefox and Chrome.